Must-Try Simple Budgeting For Kids +Free Printable

“I wish we were rich and could buy whatever we wanted!”

Sound familiar? My kids say this every time I turn down their latest toy request.

Do your kids say the same? Or maybe they spend every dollar they get faster than you can say “savings jar”?

Teaching kids how to budget doesn’t have to be overwhelming. With a few simple steps, you can help them learn smart money management skills now that will set them up for a lifetime of financial success.

Let’s show them how to earn, save, and spend wisely!

Would you like to save this idea?

Teaching Kids How To Budget: Step-By-Step

By age seven, kids already have a basic understanding of finance concepts based on what they’ve experienced (source).

Yet, over 30% of parents never discuss money with their kids (source).

There are a variety of ideas on how to teach kids budgeting and wise money management.

The most effective approaches include money practice and real-life application.

Let’s break down basic budgeting ideas for kids into 5 steps.

Step 1: Talk About Money

Start by talking about money regularly! Kids can easily miss the money transactions happening around them, especially in a cashless world.

Turn everyday activities into teachable moments:

- At the grocery store, discuss item prices and comparison shopping.

- At the ATM, explain where the money comes from.

- At a restaurant, show the bill and talk about tipping.

- At home, highlight daily expenses like water, electricity, and heating.

Last week, I told my boys it cost $53 to fill up my car. They were shocked—it really put their allowance into perspective!

Connect work and money. Help your kids understand how your family earns income and manages monthly expenses. These conversations build a foundation for smart money habits.

Step 2: Find The Right Approach

Choose one or combine the approaches below to teach kids how they’ll receive and earn money:

1. Weekly Allowance

Dr. Jazmine, The Mom Psychologist, recommends using a weekly allowance as a teaching tool, separate from chores. Kids receive a set amount each week (e.g., $1 per year of age or $5 for younger kids). This avoids power struggles over chores while focusing on money management.

2. Commission-Based Earnings

Dave Ramsey’s method ties money to effort: kids earn a commission for extra work they complete. This approach instills a strong work ethic and reinforces the principle that work = money.

What They Share

- Both approaches suggest dividing the money into three categories: spending, saving, and giving as a budgeting tool.

- They advocate that kids use their own money to buy purchases beyond the necessities.

- Both experts agree: kids shouldn’t be paid for regular daily chores. These tasks foster responsibility, curb entitlement, and teach kids the value of contributing as part of a family team.

In our house, we combine approaches: Our kids get an allowance and can earn extra money through additional chores. This keeps money management discussions regular while reinforcing the work-money connection.

The key is finding what fits your family best, with a focus on real-life application and practice.

<<Check out this list for appropriate chores for your child’s age.>>

Step 3: Spend, Save, Share

Teach kids money management with a simple system: label three jars or envelopes as Spend, Save, and Share.

For example, we give our kids (ages 5 and 7) a $5 weekly allowance, split into Spend ($3), Save ($1), and Share ($1). This easy 60-20-20 Rule Budget is perfect for beginners.

Decide how to divide their money and use the free printable at the bottom of this article to track it. Keep it simple!

Pro Tip: For younger kids, use clear jars or a moonjar toy bank so they can see their money grow. Older kids can use envelopes or open their own bank accounts to manage and divide their funds.

Spend Budgeting Category For Kids

Let your kids enjoy their spending money however they wish—but once it’s gone, it’s gone.

This can be tough for parents. We don’t want to see our kids blowing money on junk. But it’s an important part of the learning process.

We recently went to a fun event and my kids bring their spending money. They bought cotton candy and toys for $20 each.

Ultimately we ended up with mostly uneaten cotton candy and toys we haven’t played with. It became a great teaching moment on spending!

‘Spend’ money should be used for your child’s wants! While you’ll still purchase necessary items for them, use this video as a reference when your child “needs” something that truly falls under the want category.

Related: Best Chore Charts For Kids and Manage Screen Time +Printable

Save Budget Category For Kids

Saving doesn’t come naturally to all kids, so early practice is key. It teaches patience and goal-setting.

- Younger kids can set a savings goal for a larger item they want.

- Older kids may want to start saving for something bigger, like a car.

- If your child saves diligently, consider matching their savings or helping with the final amount. This encourages motivation and reinforces the value of saving for big purchases.

*Make it fun with these kids money saving games

Share (or Give) Budget Category

The “share” category teaches the importance of giving, which can be challenging for both adults and kids.

Encourage setting aside money for donations or community impact. As your child sees how giving helps others, they’ll understand the positive effect it has on them too.

Keep it all simple—create a plan that fits your family’s lifestyle and your child’s age.

Step 4: Set SMART Money Goals

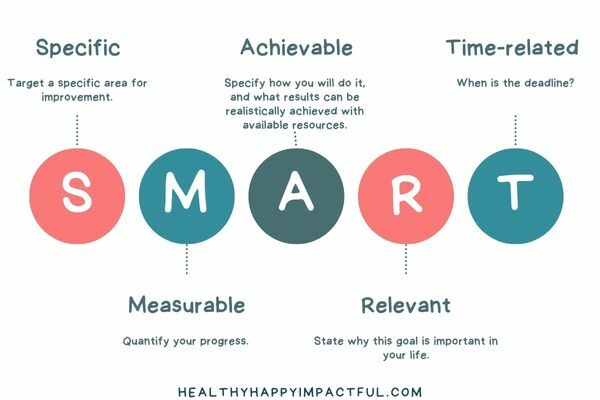

Now that you have the budgeting system set, help your kids set a goal for a bigger purchase. Setting a SMART goal will teach them to create specific, measurable, and achievable goals.

Display the goal and a picture of the item to keep them motivated.

Example: I will earn an extra $20 by the end of the month to buy a new video game. To do this, I’ll ask my parents for a list of extra chores I can complete each week.

Step 5: Model Budgeting For Kids

Remember, your kids are watching!

To set kids up for success, create and stick to a monthly budget. By living within your budget and avoiding impulse purchases, you’re showing them how to manage money.

Free Printable Budget Tracker for Kids

A budget helps kids plan for how they want to spend their money AND prepares them for successful financial futures.

Grab the free budget worksheet printable to help your child get started.

The Best Kids Budgeting Books

Need more help? Books are an easy way to introduce new topics to your kids.

A Boy, A Budget, and a Dream by Jasmine Paul (Ages 4-8)

Follow two siblings in this book as they use their money in very different ways. One of them will have to learn how to budget or give up on his dream.

Money Ninja: A Children’s Book About Saving, Investing, and Donating by Mary Nhin (Ages 3-11)

Join Money Ninja on a journey of saving, investing, and donating.

Investing for Kids: How to save, invest, and grow money by Dylin Redling (Ages 8-12)

Your kids will get money savvy with the practical advice in this book.

Smart Money Smart Kids: Raising the Next Generation to Win With Money by Dave Ramsey and Rachel Cruze

Told from this dynamic father-daughter duo, this book gives practical advice on how to start your kids on the right path to becoming money-smart adults.

What’s Next?

Enter your email below to get the best content for your family!